An Exchange Traded Fund (ETF) is an investment fund that can be bought and sold on the Australian Securities Exchange (ASX) just like ordinary shares.

There’s two types: Passive and Active

Passive ETFs

Are the most common and they track a benchmark (e.g. index, sector or commodity). Their goal is to move in line with the underlying benchmark and provide a near identical return (less fees). The difference between the ETFs return and the underlying benchmark’s return is called the “tracking error”. Fees with Passive ETFs are typical lower than Active ETFs and Managed Funds.

The largest Passive ETF of the ASX is the SPDR S&P/ASX 200 (STW) which tracks the return of the S&P/ASX 200 Index.

Active ETFs

Are less common and can be identified by the use of “Hedge Fund” or “Managed Fund” in their title. These ETFs are actively managed and aim to outperform a benchmark or follow an objective.

The most well-known Active ETF is the BetaShares Australian Equities Bear Hedge Fund (BEAR) which aims to generate returns that are negatively correlated to the returns of the S&P/ASX 200 Accumulation index.

While ETFs provide an excellent way to gain exposure to a whole market or sector through one transaction, some small funds have extremely low liquidity and might have a large “spread” in the buy/sell price.

IMPORTANT

IMPORTANTASXETFs.com doesn’t provide share price data.

The best website is Market Index.

They have current ASX share prices, company charts and announcements, dividend data, directors’ transactions and broker consensus.

What are the Pros and Cons?

ETFs have gained significant popularity over the past few years. This is primarily due to their simplicity, transparency and ability to provide exposure to a basket of shares in one transaction.

PROS

- Simplicity

You can buy and sell ETFs with your stockbroker just like ordinary shares. - Diversification

Investors can gain access to a whole portfolio of companies through one security, foreign indices and commodities. - Transparency

Fund Managers must regularly disclose their holdings along with their tracking error and fees.

CONS

- Liquidity

Some smaller funds have very low liquidity so exiting the security might be difficult or costly - Currency Fluctuations

If you're investing in an ETF that tracks an overseas benchmark then currency movements will impact your investments return.

List of ASX ETFs (1 June 2020)

Excel (CSV): Download

Excel (CSV): Download

| Code | Company | Market Cap | Weight(%) |

|---|---|---|---|

| DMKT | AMP Capital Dynamic Markets Fund (Hedge Fund) | 7,492,320 | 0.01 |

| GLIN | AMP Capital Global Infr Sec Fund (Unhedged) (Managed Fund) | 34,923,700 | 0.05 |

| AGX1 | Antipodes Global Shares (Quoted Managed Fund) | 23,004,400 | 0.03 |

| HBRD | Betashares Active Australian Hybrids Fund (Managed Fund) | 657,236,000 | 0.94 |

| ASIA | Betashares Asia Technology Tigers ETF | 118,386,000 | 0.17 |

| A200 | Betashares Australia 200 ETF | 710,995,000 | 1.02 |

| HVST | Betashares Australian Dividend Harvester Fund (Managed Fund) | 125,924,000 | 0.18 |

| BEAR | Betashares Australian Equities Bear (Hedge Fund) | 121,655,000 | 0.17 |

| EX20 | Betashares Australian Ex-20 Portfolio Diversifier ETF | 109,787,000 | 0.16 |

| AGVT | Betashares Australian Government Bond ETF | 12,476,700 | 0.02 |

| AAA | Betashares Australian High Interest Cash ETF | 1,753,530,000 | 2.52 |

| CRED | Betashares Australian Investment Grade Corporate Bond ETF | 325,794,000 | 0.47 |

| BBOZ | Betashares Australian Strong Bear (Hedge Fund) | 320,410,000 | 0.46 |

| FAIR | Betashares Australian Sustainability Leaders ETF | 496,474,000 | 0.71 |

| EEU | Betashares Euro ETF | 10,593,400 | 0.02 |

| HEUR | Betashares Europe ETF-Currency Hedged | 23,386,400 | 0.03 |

| F100 | Betashares Ftse 100 ETF | 130,624,000 | 0.19 |

| GEAR | Betashares Geared Australian Equity Fund (Hedge Fund) | 166,898,000 | 0.24 |

| GGUS | Betashares Geared US Equity Fund Currency Hedged (Hedgefund) | 40,950,000 | 0.06 |

| FOOD | Betashares Global Agriculture ETF - Currency Hedged | 16,634,000 | 0.02 |

| BNKS | Betashares Global Banks ETF - Currency Hedged | 19,575,500 | 0.03 |

| HACK | Betashares Global Cybersecurity ETF | 205,348,000 | 0.3 |

| FUEL | Betashares Global Energy Companies ETF - Currency Hedged | 144,634,000 | 0.21 |

| MNRS | Betashares Global Gold Miners ETF - Currency Hedged | 21,057,300 | 0.03 |

| DRUG | Betashares Global Healthcare ETF - Currency Hedged | 41,618,400 | 0.06 |

| INCM | Betashares Global Income Leaders ETF | 15,951,700 | 0.02 |

| ETHI | Betashares Global Sustainability Leaders ETF | 645,125,000 | 0.93 |

| IIND | Betashares India Quality ETF | 21,031,300 | 0.03 |

| HJPN | Betashares Japan ETF-Currency Hedged | 31,114,900 | 0.04 |

| BNDS | Betashares Legg Mason Australian Bond Fund (Managed Fund) | 114,807,000 | 0.16 |

| EMMG | Betashares Legg Mason Emerging Markets Fund (Managed Fund) | 9,896,780 | 0.01 |

| EINC | Betashares Legg Mason Equity Income Fund (Managed Fund) | 22,886,100 | 0.03 |

| AUST | Betashares Managed Risk Australian Share Fund (Managed Fund) | 45,254,300 | 0.07 |

| AUDS | Betashares Strong Australian Dollar Fund (Hedge Fund) | 11,688,000 | 0.02 |

| BBUS | Betashares US Equities Strong Bear Currency Hedged (HF) | 243,459,000 | 0.35 |

| IMPQ | Einvest Future Impact Small Caps Fund (Managed Fund) | 1,409,040 | 0 |

| EIGA | Einvest Income Generator Fund (Managed Fund) | 21,482,600 | 0.03 |

| ACDC | ETFs Battery Tech & Lithium ETF | 18,595,500 | 0.03 |

| ESTX | ETFs Euro STOXX 50 ETF | 47,008,000 | 0.07 |

| CORE | ETFs Global Core Infrastructure ETF | 18,837,400 | 0.03 |

| ETPMAG | ETFs Group | 103,733,000 | 0.15 |

| ETPMPD | ETFs Group | 4,984,060 | 0.01 |

| ETPMPM | ETFs Group | 12,192,700 | 0.02 |

| ETPMPT | ETFs Group | 5,692,190 | 0.01 |

| GOLD | ETFs Metal Securities Australia Ltd | 1,368,830,000 | 1.97 |

| CURE | ETFs S&P Biotech ETF | 9,114,810 | 0.01 |

| FEMX | Fidelity Global Emerging Markets Fund (Managed Fund) | 77,034,900 | 0.11 |

| INIF | Intelligent Investor Aus Equity Income Fund (Managed Fund) | 26,625,900 | 0.04 |

| INES | Intelligent Investor Ethical Share Fund (Managed Fund) | 19,354,400 | 0.03 |

| IAA | Ishares Asia 50 ETF | 501,226,000 | 0.72 |

| IZZ | Ishares China Large-Cap ETF | 98,482,700 | 0.14 |

| BILL | Ishares Core Cash ETF | 512,064,000 | 0.74 |

| IAF | Ishares Core Composite Bond ETF | 1,118,020,000 | 1.61 |

| IHCB | Ishares Core Global Corporate Bond(Aud Hedged) ETF | 295,311,000 | 0.42 |

| IHWL | Ishares Core MSCI World All Cap (Aud Hedged) ETF | 83,096,800 | 0.12 |

| IWLD | Ishares Core MSCI World All Cap ETF | 116,738,000 | 0.17 |

| IOZ | Ishares Core S&P/ASX 200 ETF | 1,987,430,000 | 2.86 |

| AUMF | Ishares Edge MSCI Australia Multifactor ETF | 16,161,400 | 0.02 |

| ISEC | Ishares Enhanced Cash ETF | 201,709,000 | 0.29 |

| IEU | Ishares Europe ETF | 526,745,000 | 0.76 |

| IHOO | Ishares Global 100 Aud Hedged ETF | 78,803,600 | 0.11 |

| IOO | Ishares Global 100 ETF | 1,746,150,000 | 2.51 |

| IXI | Ishares Global Consumer Staples ETF | 173,331,000 | 0.25 |

| IXJ | Ishares Global Healthcare ETF | 719,929,000 | 1.03 |

| IHHY | Ishares Global High Yield Bond (Aud Hedged) ETF | 57,565,300 | 0.08 |

| ILB | Ishares Government Inflation ETF | 134,182,000 | 0.19 |

| IHEB | Ishares J.P. Morgan Usd Emerging Markets (Aud Hedged) ETF | 31,688,400 | 0.05 |

| IVE | Ishares MSCI Eafe ETF | 353,333,000 | 0.51 |

| IEM | Ishares MSCI Emerging Markets ETF | 656,583,000 | 0.94 |

| IJP | Ishares MSCI Japan ETF | 290,140,000 | 0.42 |

| IKO | Ishares MSCI South Korea ETF | 77,700,800 | 0.11 |

| IHVV | Ishares S&P 500 Aud Hedged ETF | 526,098,000 | 0.76 |

| IVV | Ishares S&P 500 ETF | 3,161,690,000 | 4.54 |

| IJH | Ishares S&P Mid-Cap ETF | 119,184,000 | 0.17 |

| IJR | Ishares S&P Small-Cap ETF | 162,233,000 | 0.23 |

| ILC | Ishares S&P/ASX 20 ETF | 302,821,000 | 0.44 |

| IHD | Ishares S&P/ASX Dividend Opportunities ETF | 271,089,000 | 0.39 |

| ISO | Ishares S&P/ASX Small Ordinaries ETF | 95,920,200 | 0.14 |

| IGB | Ishares Treasury ETF | 64,733,700 | 0.09 |

| KSM | K2 Australian Small Cap Fund (Hedge Fund) | 12,633,800 | 0.02 |

| MGE | Magellan Global Equities Fund (Managed Fund) | 1,676,750,000 | 2.41 |

| MHG | Magellan Global Equities Fund Currency Hedged (Managed Fund) | 165,360,000 | 0.24 |

| MICH | Magellan Infrastructure Fund (Currency Hedged)(Managed Fund) | 580,344,000 | 0.83 |

| MOGL | Montgomery Global Equities Fund (Managed Fund) | 82,861,300 | 0.12 |

| GROW | Schroder Real Return Fund (Managed Fund) | 39,554,600 | 0.06 |

| DJRE | SPDR Dow Jones Global Real Estate Fund | 277,690,000 | 0.4 |

| BOND | SPDR S&P/ASX Australian Bond Fund | 46,125,000 | 0.07 |

| GOVT | SPDR S&P/ASX Australian Government Bond Fund | 25,933,600 | 0.04 |

| MONY | Ubs IQ Cash ETF | 1,901,270 | 0 |

| DIV | Ubs IQ Morningstar Australia Dividend Yield ETF | 12,033,900 | 0.02 |

| ETF | Ubs IQ Morningstar Australia Quality ETF | 4,882,000 | 0.01 |

| FLOT | Vaneck Vectors Australian Floating Rate ETF | 263,925,000 | 0.38 |

| MVA | Vaneck Vectors Australian Property ETF | 198,205,000 | 0.28 |

| CNEW | Vaneck Vectors China New Economy ETF | 73,536,800 | 0.11 |

| CETF | Vaneck Vectors Ftse China A50 ETF | 23,261,800 | 0.03 |

| IFRA | Vaneck Vectors Ftse Global Infrastructure (Hedged) ETF | 214,111,000 | 0.31 |

| GDX | Vaneck Vectors Gold Miners ETF | 256,520,000 | 0.37 |

| MOAT | Vaneck Vectors Morningstar Wide Moat ETF | 162,763,000 | 0.23 |

| GRNV | Vaneck Vectors MSCI Australian Sustainable Equity ETF | 54,444,900 | 0.08 |

| ESGI | Vaneck Vectors MSCI International Sustainable Equity ETF | 34,885,400 | 0.05 |

| EMKT | Vaneck Vectors MSCI Multifactor Emerging Markets Equity ETF | 28,996,300 | 0.04 |

| MVB | Vaneck Vectors Australian Banks ETF | 49,410,400 | 0.07 |

| MVE | Vaneck Vectors S&P/ASX Midcap ETF | 117,128,000 | 0.17 |

| MVOL | Ishares Edge MSCI Australia Minimum Volatility ETF | 44,941,800 | 0.06 |

| MVR | Vaneck Vectors Australian Resources ETF | 54,325,900 | 0.08 |

| MVS | Vaneck Vectors Small Companies Masters ETF | 59,295,100 | 0.09 |

| MVW | Vaneck Vectors Australian EQUAL Weight ETF | 1,035,590,000 | 1.49 |

| NDIA | ETFs Reliance India Nifty 50 ETF | 10,737,900 | 0.02 |

| NDQ | Betashares Nasdaq 100 ETF | 818,825,000 | 1.18 |

| OOO | Betashares Crude Oil INDEX ETF-Currency Hedged (Synthetic) | 213,656,000 | 0.31 |

| OZF | SPDR S&P/ASX 200 Financials Ex A-REIT Fund | 63,954,800 | 0.09 |

| OZR | SPDR S&P/ASX 200 Resources Fund | 77,260,900 | 0.11 |

| PAXX | Platinum Asia Fund (Quoted Managed Hedge Fund) | 141,586,000 | 0.2 |

| PIXX | Platinum International Fund (Quoted Managed Hedge Fund) | 328,581,000 | 0.47 |

| PLUS | Vaneck Vectors Australian Corporate Bond Plus ETF | 250,500,000 | 0.36 |

| PMGOLD | Gold Corporation | 8,320,420,000 | 11.96 |

| POU | Betashares British Pound ETF | 20,667,400 | 0.03 |

| QAG | Betashares Agriculture ETF-Currency Hedged (Synthetic) | 2,875,280 | 0 |

| QAU | Betashares Gold Bullion ETF - Currency Hedged | 229,805,000 | 0.33 |

| QCB | Betashares Commodities Basket ETF-Currency Hedged(Synthetic) | 6,869,630 | 0.01 |

| QFN | Betashares Australian Financials Sector ETF | 14,092,500 | 0.02 |

| QHAL | Vaneck Vectors MSCI World Ex Australia Quality (Hedged) ETF | 165,173,000 | 0.24 |

| QLTY | Betashares Global Quality Leaders ETF | 45,021,000 | 0.06 |

| QMIX | SPDR MSCI World Quality MIX Fund | 23,838,700 | 0.03 |

| QOZ | Betashares Ftse Rafi Australia 200 ETF | 226,860,000 | 0.33 |

| QPON | Betashares Australian Bank Senior Floating Rate Bond ETF | 726,725,000 | 1.04 |

| QRE | Betashares Australian Resources Sector ETF | 69,814,200 | 0.1 |

| QUAL | Vaneck Vectors MSCI World Ex Australia Quality ETF | 1,023,230,000 | 1.47 |

| QUS | Betashares Ftse Rafi U.S. 1000 ETF | 47,482,900 | 0.07 |

| RARI | Russell Investments Australian Responsible Investment ETF | 225,040,000 | 0.32 |

| RBTZ | Betashares Global Robotics and Artificial Intelligence ETF | 34,950,400 | 0.05 |

| RCB | Russell Investments Australian Select Corporate Bond ETF | 226,059,000 | 0.32 |

| RDV | Russell Investments High Dividend Australian Shares ETF | 232,339,000 | 0.33 |

| REIT | Vaneck Vectors Ftse International Property (Hedged) ETF | 32,703,200 | 0.05 |

| RENT | AMP Capital Global Prop Sec Fund (Unhedged) (Managed Fund) | 22,902,100 | 0.03 |

| RGB | Russell Investments Australian Government Bond ETF | 81,323,500 | 0.12 |

| RINC | Betashares Legg Mason Real Income Fund (Managed Fund) | 42,947,500 | 0.06 |

| ROBO | ETFs Robo Global Robotics and Automation ETF | 124,332,000 | 0.18 |

| RSM | Russell Investments Australian Semi-Government Bond ETF | 61,543,900 | 0.09 |

| SFY | SPDR S&P/ASX 50 Fund | 587,550,000 | 0.84 |

| SLF | SPDR S&P/ASX 200 Listed Property Fund | 495,302,000 | 0.71 |

| SMLL | Betashares Aust Small Companies Select Fund (Managed Fund) | 33,693,300 | 0.05 |

| SPY | SPDR S&P 500 ETF Trust | 40,093,700 | 0.06 |

| SSO | SPDR S&P/ASX Small Ordinaries Fund | 21,442,800 | 0.03 |

| STW | SPDR S&P/ASX 200 Fund | 3,661,200,000 | 5.26 |

| SWTZ | Switzer Dividend Growth Fund (Managed Fund) | 75,359,100 | 0.11 |

| SYI | SPDR MSCI Australia Select High Dividend Yield Fund | 158,590,000 | 0.23 |

| TECH | ETFs Morningstar Global Technology ETF | 139,973,000 | 0.2 |

| UBA | Ubs IQ MSCI Australia Ethical ETF | 141,521,000 | 0.2 |

| UBE | Ubs IQ MSCI Europe Ethical ETF | 7,141,020 | 0.01 |

| UBJ | Ubs IQ MSCI Japan Ethical ETF | 3,090,730 | 0 |

| UBP | Ubs IQ MSCI Asia APEX 50 Ethical ETF | 6,509,170 | 0.01 |

| UBU | Ubs IQ MSCI Usa Ethical ETF | 3,748,180 | 0.01 |

| UBW | Ubs IQ MSCI World Ex Australia Ethical ETF | 32,951,600 | 0.05 |

| UMAX | Betashares S&P 500 Yield Maximiser Fund (Managed Fund) | 85,884,600 | 0.12 |

| USD | Betashares U.S. Dollar ETF | 309,438,000 | 0.44 |

| VACF | Vanguard Australian Corp Fixed Interest INDEX ETF | 324,102,000 | 0.47 |

| VAE | Vanguard Ftse Asia Ex Japan Shares INDEX ETF | 173,841,000 | 0.25 |

| VAF | Vanguard Australian Fixed Interest INDEX ETF | 1,370,370,000 | 1.97 |

| VAP | Vanguard Australian Property Securities INDEX ETF | 1,465,430,000 | 2.11 |

| VAS | Vanguard Australian Shares INDEX ETF | 5,073,860,000 | 7.29 |

| VBLD | Vanguard Global Infrastructure INDEX ETF | 90,986,800 | 0.13 |

| VBND | Vanguard Global Aggregate Bond INDEX (Hedged) ETF | 147,323,000 | 0.21 |

| VCF | Vanguard International Credit Securities INDEX (Hedged) ETF | 207,462,000 | 0.3 |

| VDBA | Vanguard Diversified Balanced INDEX ETF | 243,763,000 | 0.35 |

| VDCO | Vanguard Diversified Conservative INDEX ETF | 106,086,000 | 0.15 |

| VDGR | Vanguard Diversified Growth INDEX ETF | 239,209,000 | 0.34 |

| VDHG | Vanguard Diversified High Growth INDEX ETF | 366,969,000 | 0.53 |

| VEFI | Vanguard Ethically Conscious GLB Agg Bond INDEX (Hedged) ETF | 16,716,700 | 0.02 |

| VEQ | Vanguard Ftse Europe Shares ETF | 172,314,000 | 0.25 |

| VESG | Vanguard Ethically Conscious International Shares INDEX ETF | 107,396,000 | 0.15 |

| VEU | Vanguard All-World Ex-US Shares INDEX ETF | 1,533,930,000 | 2.2 |

| VGAD | Vanguard MSCI INDEX International Shares (Hedged) ETF | 935,091,000 | 1.34 |

| VGB | Vanguard Australian Government Bond INDEX ETF | 484,979,000 | 0.7 |

| VGE | Vanguard Ftse Emerging Markets Shares ETF | 332,643,000 | 0.48 |

| VGMF | Vanguard Global Multi-Factor Active ETF (Managed Fund) | 16,003,700 | 0.02 |

| VGS | Vanguard MSCI INDEX International Shares ETF | 2,079,220,000 | 2.99 |

| VHY | Vanguard Australian Shares High Yield ETF | 1,263,320,000 | 1.82 |

| VIF | Vanguard International Fixed Interest INDEX (Hedged) ETF | 484,114,000 | 0.7 |

| VISM | Vanguard MSCI International Small Companies INDEX ETF | 33,452,000 | 0.05 |

| VLC | Vanguard MSCI Australian Large Companies INDEX ETF | 94,795,200 | 0.14 |

| VMIN | Vanguard Global Minimum Volatility Active ETF (Managed Fund) | 11,811,700 | 0.02 |

| VSO | Vanguard MSCI Australian Small Companies INDEX ETF | 359,005,000 | 0.52 |

| VTS | Vanguard US Total Market Shares INDEX ETF | 1,818,380,000 | 2.61 |

| VVLU | Vanguard Global Value Equity Active ETF (Managed Fund) | 20,814,300 | 0.03 |

| WCMQ | WCM Quality Global Growth Fund (Quoted Managed Fund) | 108,278,000 | 0.16 |

| WDIV | SPDR S&P Global Dividend Fund | 245,949,000 | 0.35 |

| WDMF | Ishares Edge MSCI World Multifactor ETF | 241,005,000 | 0.35 |

| WEMG | SPDR S&P Emerging Markets Fund | 19,962,800 | 0.03 |

| WRLD | Betashares Managed Risk Global Share Fund (Managed Fund) | 58,414,500 | 0.08 |

| WVOL | Ishares Edge MSCI World Minimum Volatility ETF | 116,361,000 | 0.17 |

| WXHG | SPDR S&P World Ex Australia (Hedged) Fund | 93,577,100 | 0.13 |

| WXOZ | SPDR S&P World Ex Australia Fund | 186,835,000 | 0.27 |

| XARO | Activex Ardea Real Outcome Bond Fund (Managed Fund) | 168,611,000 | 0.24 |

| YANK | Betashares Strong U.S. Dollar Fund (Hedge Fund) | 10,200,000 | 0.01 |

| YMAX | Betashares Aus Top 20 Equity Yield MAX Fund (Managed Fund) | 242,619,000 | 0.35 |

| ZUSD | ETFs Enhanced Usd Cash ETF | 11,702,200 | 0.02 |

| ZYAU | ETFs S&P/ASX 300 High Yield Plus ETF | 116,560,000 | 0.17 |

| ZYUS | ETFs S&P 500 High Yield Low Volatility ETF | 70,808,100 | 0.1 |

Archived Lists

How many ASX-listed ETFs are there?

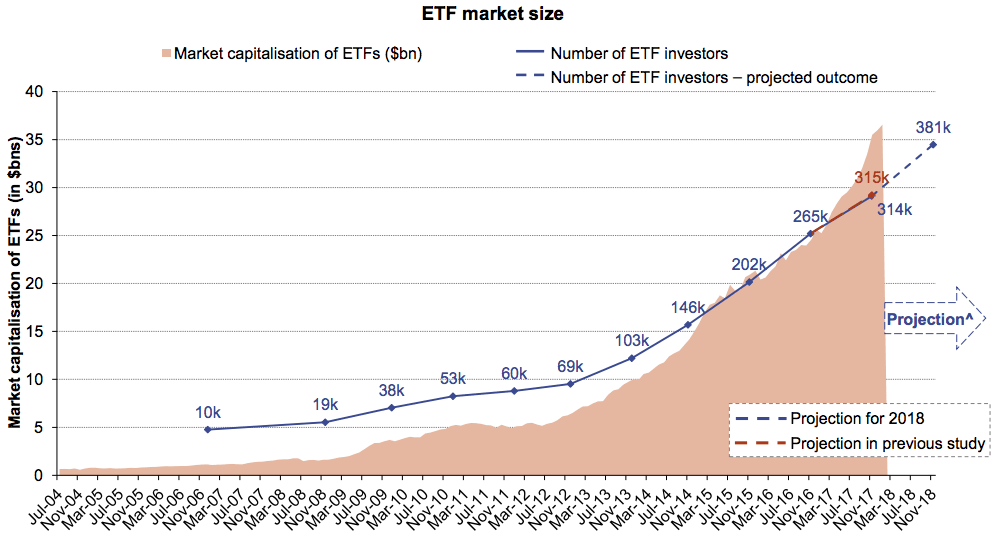

There's over 150 ETFs and the number is growing rapidly with a combined market capitalisation over $35B.

The number of ETF investors in September 2017 was 314,000 which was up 18% from 12months prior.

Who invests in ETFs?

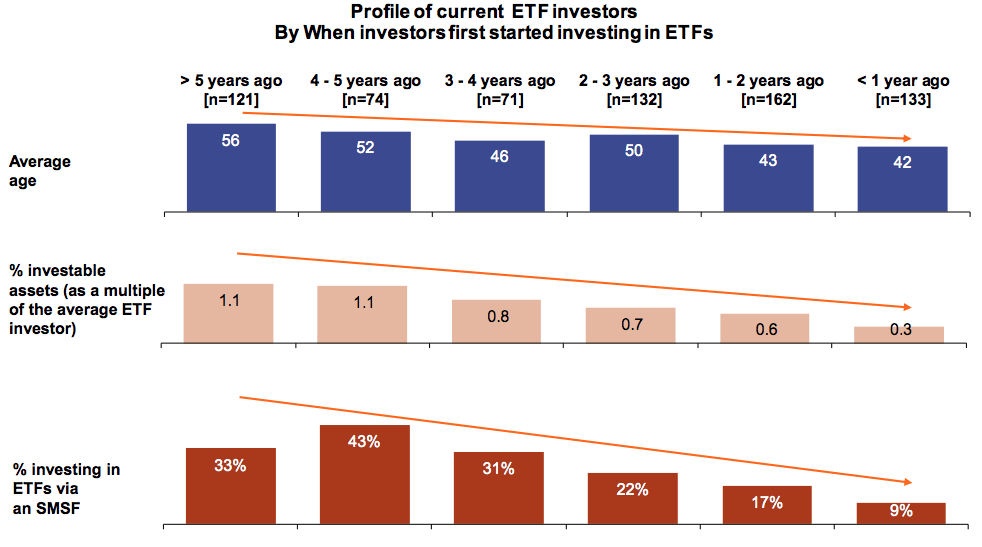

The average ETF investor 49 years old. One in 4 is retired, 33% invest via a SMSF and 56% intend to re-invest in ETFs in 2018.

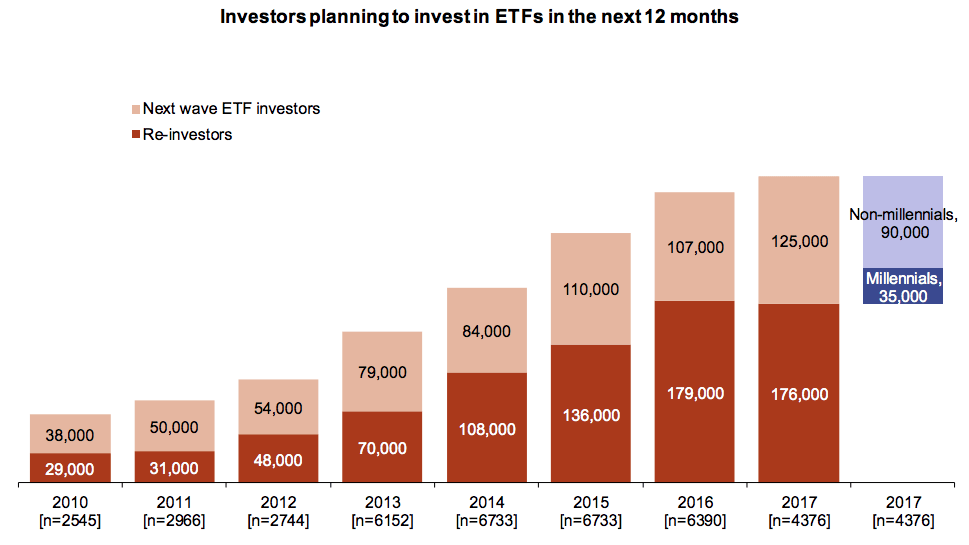

Of the 125,000 new investors in 2018, 35,000 (39%) are expected to be Millennials.

The profile of an ETF investor is changing over time. The average age an investor first started investing in ETFs has fallen from 56 5 years ago to 42 in 2017.

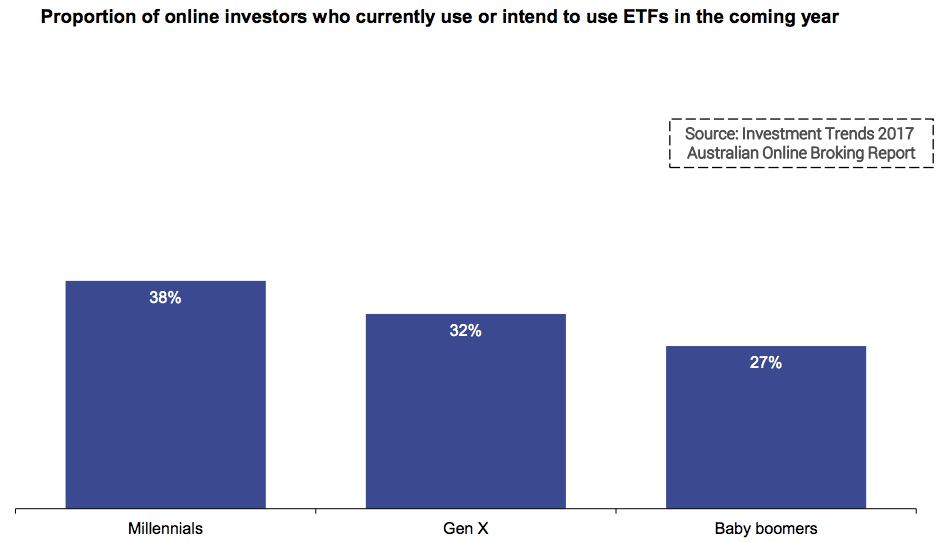

Millennial are now (by proportion) the most likely demographic to invest in ETFs in 2018. 38% expect to use ETFs in their investment portfolio as compared to just 27% of Baby Boomers.

Resources

All ASX ETFs Grouped by Benchmark - compiled by Market Index.

Statistics on this page - provided by BetaShares.

ETF Course - on the ASX Website.